Ridgewood Center is a fully stabilized asset with a 4.07 WALT & 7.25% cap rate

32,334

TOTAL SF

100%

Occupancy

Kidder Mathews, as the exclusive advisor, is pleased to present the opportunity to acquire Ridgewood Center, a fully leased, multi-tenant office property strategically located in one of suburban Seattle's most dynamic and high-performing submarkets.

This fully stabilized office building offers investors a reliable income stream supported by a diverse mix of eight tenants representing a range of industries, including both professional office users and medical service providers. This tenant diversity reduces exposure to any single sector and enhances overall asset resilience. With a Weighted Average Lease Term (WALT) of approximately 4.07 years and no lease expirations for more than two (2) years, the property provides strong near- and long-term income security. The staggered lease maturities further contribute to long-term cash flow stability, positioning the asset as a low-risk, income-generating investment opportunity.

Property Pricing

$7.74M

LIST PRICE

$239.37

LIST PRICE PSF

Cap Rates

7.25%

YEAR 1

7.47%

YEAR 2

Unleveraged IRR

9.37%

10-YEAR HOLDING PERIOD

Leveraged IRR

12.80%

10-YEAR HOLDING PERIOD (INTEREST RATE 6.50%)

Debt Assumption: Fixed rate debt,6.50%, 25 year amort, 65% LTV.

Debt verified with Crux, March 2025. Argus Model available upon

confidentiality agreement execution.

This fully stabilized office building offers investors a reliable income stream backed by eight tenants across professional office and medical sectors. The diverse tenant mix reduces exposure to any single industry and strengthens overall asset stability. With a Weighted Average Lease Term (WALT) of approximately 4.07 years and no expirations for over two (2) years, the property ensures near- and mid-term income security. Staggered lease maturities further enhance long-term cash flow, positioning the asset as a low-risk investment.

At the offering price of $7,740,000, the asset delivers an attractive in-place capitalization rate of 7.25% in Year One and 7.47% in Year Two. Preliminary lender feedback suggests that conservative debt financing of up to 65% loan-to-value is available at an interest rate of approximately 6.50%. Based on these assumptions, the investment is projected to generate an unleveraged internal rate of return (IRR) of approximately 9.37%, and a leveraged IRR of 12.80%, offering compelling risk-adjusted returns.

Ridgewood Center, occupied by eight (8) tenants across a mix of professional office and medical uses, exemplifies a fully stabilized, low risk office investment. The tenant base, comprising both local and national operators, supports strong renewal potential and long term income growth throughout the hold period. With a Weighted Average Lease Term (WALT) of approximately 4.07 years and no lease expirations for over two (2) years, this asset offers the kind of stability both investors and lenders value.

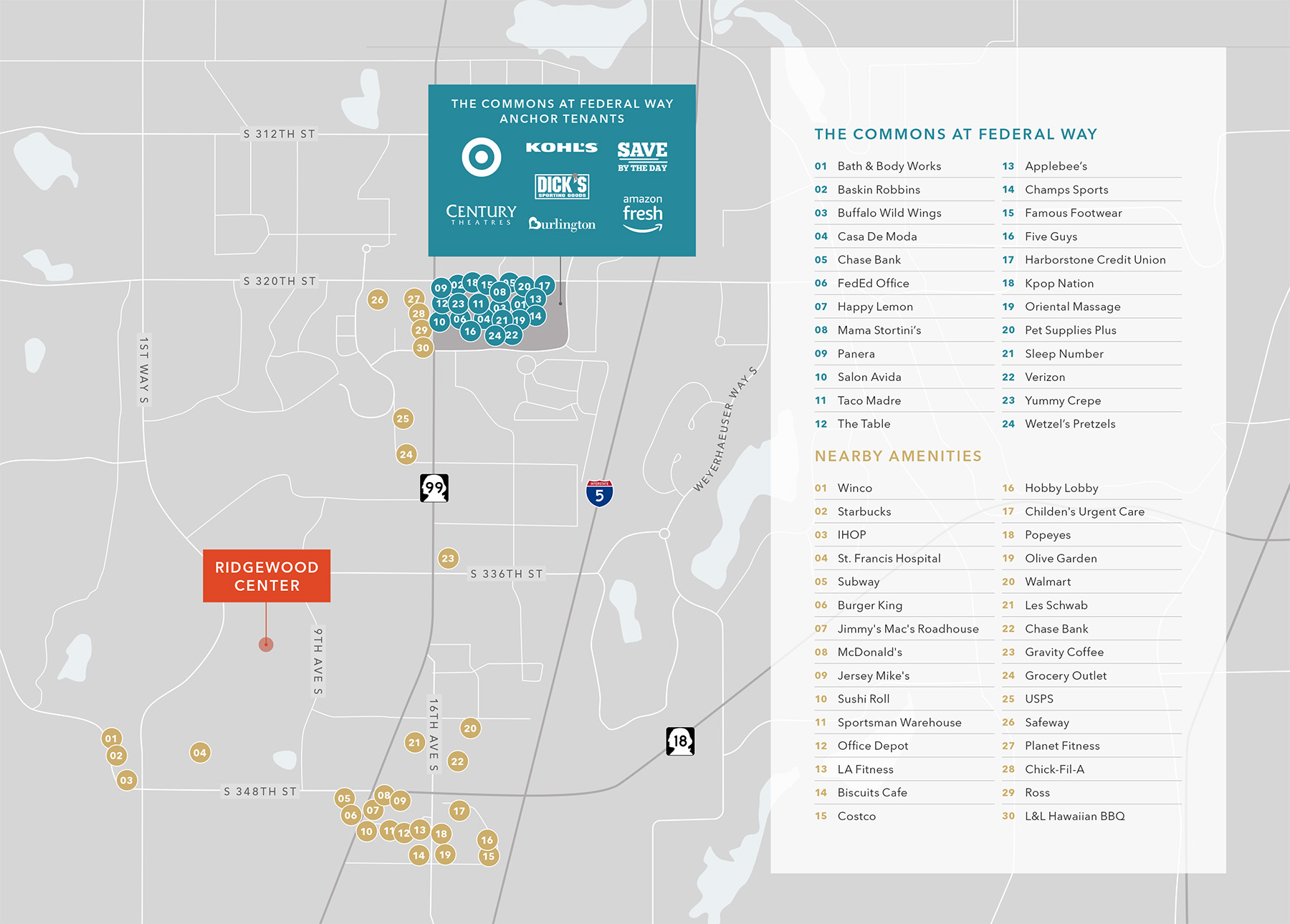

Federal Way stands out as the strongest performing submarket in the South Puget Sound region. Regional and national tenants view Federal Way as an ideal location for corporate headquarters or satellite offices. In today's market environment, where tech-centric submarkets face heightened scrutiny, the South Sound region is increasingly attracting investor interest. Traditionally trading at a discount to Bellevue and Seattle, the South Sound is anchored by stable, traditional users such as financial services firms and law practices, a profile that is gaining favor among investors. Strong absorption trends and the submarket's proven resilience further reinforce its appeal as a reliable and attractive investment opportunity.